Ohioans, need health insurance because no one can predict what medical expenses are going to come up today, tomorrow, in a week, a month or a year, and health insurance protects a family from unexpected medical expenses resulting from a serious injury and/or unforeseen illness. Knowing that family members are protected brings peace of mind to the family. In addition, research has shown a link between getting better health care and having health insurance and because people who have health insurance are more likely to also have a regular doctor and they will have better access to medical care when it is needed.

Help me Find Ohio Health Insurance Quotes! Call 877-991-4249.

Learn about Ohio Health Exchange Plans

In Ohio employers can offer health insurance to their full-time employees and families, however they are not legally required to do so and a number of employers, choose not to provide health care plans for their workers. With the huge Ohio unemployment numbers and the many company cutbacks, it is harder than ever to find a job that offers health insurance coverage. In some instances, Ohioans are working two part-time jobs and are not offered full-time hours to work the time needed to be offered group health insurance.

Families not qualifying for employer health benefits have two other options before seeking assistance for health insurance from the state, which nearly always costs more than buying into a group health insurance policy, unless you are at poverty level and then you can get possibly get on medicaid for one year.

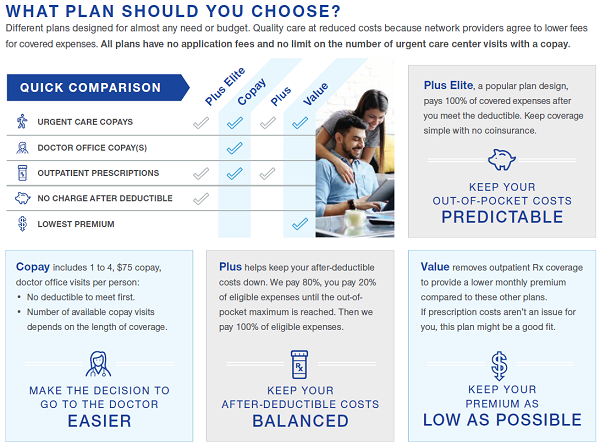

One of these options for getting reasonably priced health insurance in Ohio is to get a quote on a high deductible PPO copay plan, such as the plans offered through Anthem Ohio SmartSense. Fortunately, these policies are more affordable for the ordinary person because of the higher deductible and limited office visits.

A second option for obtaining affordable health insurance in Ohio is to establish a Health Savings Account, also known as an HSA. These health insurance policies usually quote at a good rate and do provide 100% preventive coverage, but are subject to deductible on other services. These plans do provide a way for a family to save money that might be needed for a future doctor’s visit, medical treatments and provide a tax write off.

The following is a list of companies that sell health insurance in Ohio with comments found online about their individual policies:

Anthem SmartSense – has a $35 Co-pay on office visits with no deductible for generic prescriptions.

Anthem Luminos Health Savings Account – considered to be a top carrier with preventative coverage and excellent premium.

Medical Mutual SuperMed One – has a basic policy.

UnitedHealthOne Copay Select – Sold traditional benefits benefits including unlimited office visits and brand name and generic drug coverage.

Celtic Preferred Select – Celtic’s best policy.

Aetna MC Open Access Value – excellent coverage for people with pre-existing conditions.

UnitedHealthCare – Great policies offered through Golden Rule Insurance and UnitedHealthOne.

Can’t get approved for Health Insurance?

If you got an Ohio health insurance quote, applied, and was declined coverage, then you have to check with Healthcare.gov. Here you will be offered coverage an a very high premium.